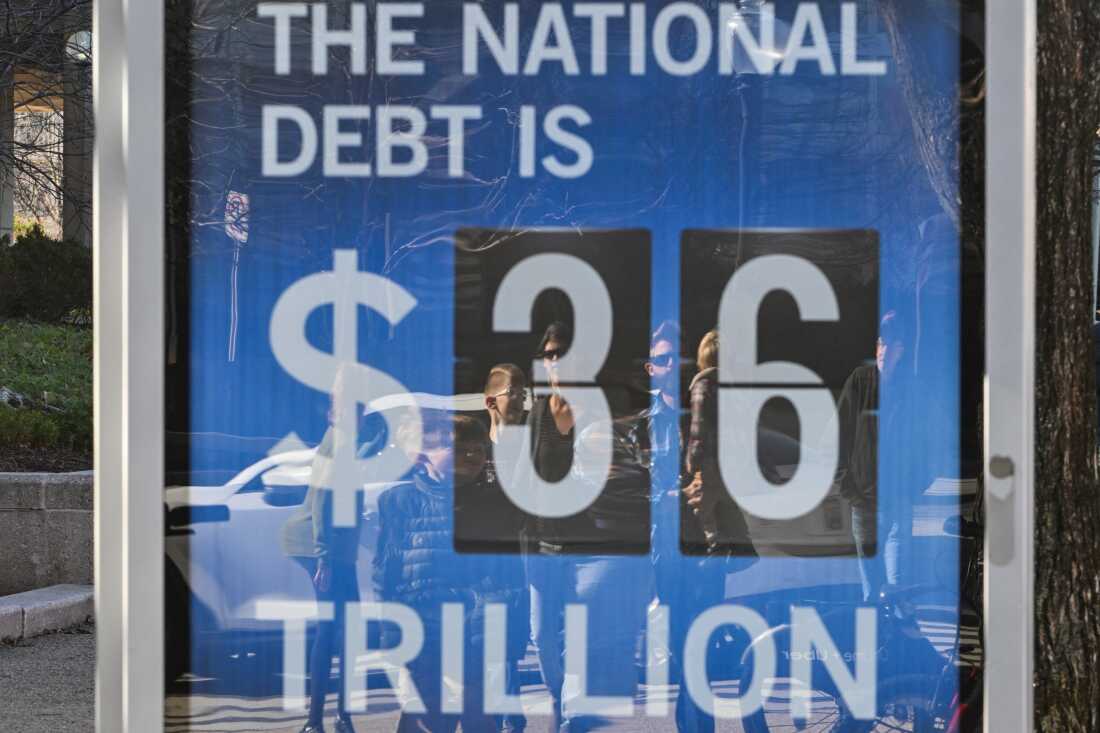

Revenue raised by President Trump’s tariffs could reduce federal deficits by $2.8 trillion over the next decade, according to a new forecast from the non-partisan Congressional Budget Office. Roberto Schmidt/AFP

Congressional forecasters say President Trump’s tariffs could raise trillions of dollars over the next decade — if they remain in place — more than offsetting the additional red ink that’s projected to flow from a sweeping budget bill passed by the House last month.

Since taking office in January, Trump has imposed taxes of 10 to 50% on nearly everything the U.S. imports. Those taxes have already raised tens of billions of dollars in revenue.

If the tariffs become permanent, they’re expected to reduce the federal deficit by $2.8 trillion by 2035, according to a letter released Wednesday by the non-partisan Congressional Budget Office.

A separate CBO forecast out earlier in the day shows the combination of tax cuts and spending cuts in the House-passed budget bill would increase the deficit by $2.4 trillion over the same period.

There are big unknowns, however

The tariff forecast includes a number of caveats.

“Because the United States has implemented no increases in tariffs of this size in many decades, there is little relevant empirical evidence on their effects,” writes CBO director Phillip Swagel. The high taxes might discourage imports more than expected, which would result in lower revenues. On the other hand, if imports drop less than expected due to tariffs, the government could end up raising more money.

The forecast assumes that most of the tariffs in place in mid-May are made permanent. It does not include the doubling of tariffs on steel and aluminum imports that took effect Wednesday, or the prospect that higher tariffs, which have been temporarily suspended, might return.

Many of the tariffs were imposed under a novel reading of a 1977 law, and they are being challenged in court, though they remain in effect for now.

In addition to cutting deficits, forecasters project the tariffs will result in higher inflation this year and next and slower economic growth.

Forecasters say tariffs will likely raise prices for both rich families and poor families, although the CBO is still sorting out which end of the income ladder would be hit hardest.